Yet another Banking Crash

Is the Collapse of the SVB the repeat of the spectacular fraud-ridden a la Madoff Ponzi scheme of 2008?

Were the big wigs at the bank con artists like Bernie too?

'The collapse of Silicon Valley Bank - the second-largest bank failure in US history -

sent anxiety across the financial system and shook the tech industry.' REUTERS/Dado Ruvic/Illustration

‘Silicon Valley Bank collapse is the second-largest failure in American history, followed by the Lehman Brothers financial crisis in 2008. The regulators shut down the bank entirely on Friday and seized the deposits. It all started on Wednesday when SVB needed to raise nearly $2.25 billion. When the bank failed to raise capital, it sold securities in loss to shore up the balance sheet. Investors reacted to this, and the bank’s share price fell over 60%. The venture capital firms also advised companies to withdraw their deposits. The banking sector has been deeply hit by the wave of SVB’s failure. Signature Bank of New York has also been shut down on Sunday, registering the third largest fall in the US…’-The Inside Story of Silicon Valley Bank’s Failure

See also: The SVB debacle has exposed the hypocrisy of Silicon Valley

‘As of mid-day 14 March, market panic caused by SVB collapse has wiped £382bn off bank stocks in recent days.’

The collapse of the US-based Silicon Valley Bank (SVB) and to a lesser extent the Signature Bank have rattled the markets across the world, raising the most uncomfortable questions: Will the 2008 financial crisis repeat?

Nota bene

A Journey Back in Time

Photo: 7 things You Need to Know to Simply Understand Lehman Brothers Collapse

‘On Monday, September 15, 2008, at 1:45 a.m Lehman Brothers Holdings Inc. filed a bankruptcy petition in the United States Bankruptcy Court for the Southern District of New York.

It was the largest bankruptcy proceeding in U.S. history. The 164-year-old firm was the fourth-largest U.S. investment bank, and its bankruptcy kicked off a global financial crisis.

Lehman used a high-leverage business model that required it to raise billions of dollars every day to keep the doors open. In 2006, it had invested heavily in high-risk real estate and subprime mortgages. When these markets turned south, Lehman couldn’t raise enough cash to stay in business…’- And the rest is history

See also:

Greed of Profit Maximisation and the Robbery of the Century in London

The 2008 Financial Crisis Explained: Hyman Minsky Revisited

Neoliberal Capitalism and Valueless Oligarchy are the Enemies of Humanity: They Have Corrupted our Humanity

He has now at least Brought Three Houses of Cards Down

The Man with no Moral Compass

Yet again, another Culprit with a Wasted Education and a Valueless MBA!

The Theft of the Century by the Most 'Educated Thieves'- All with MBAs and PhDs!

Joseph Gentile was at the centre of three scandal companies:

SVB, Lehman Brothers and Arthur Andersen

Photo: Via Esquire

‘Well, well, well, it seems the collapse of Silicon Valley Bank (SVB) has brought a certain individual back into the spotlight. Joseph Gentile, the bank’s Chief Administrative Officer, has been making headlines due to his past involvement with Lehman Brothers, the global finance firm that famously went bankrupt during the 2008 financial crisis.

Yup, you read that right, the same guy who used to be Lehman Brothers’ Chief Financial Officer (CFO) is now at the center of attention in the SVB debacle.

SVB, once the premier financial institution for tech and health startup businesses in the US, has been in a rapid downward spiral since Friday, with customers starting to withdraw their deposits due to the bank’s investments being adversely affected by recently hiked interest rates…’-Read more

Watch this telling, timeless video on Education and Propaganda: An MBA a Day Keeps Financial Collapses Coming!!

Joseph Gentile in the Video calls himself: Mr. Inside.

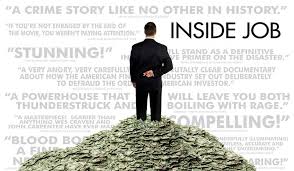

Thus, it is vitally important to see more on Inside Job by the Inside Men!!

Lest We Forget

Today, by and large, our compromised, neoliberalised, marketised universities are nothing but an Inside Job!

Photo credit and more:

Inside Job: A Crime Story Like No Other In History

See also:

SVB collapse: Here's everything you need to know

Silicon Valley Bank: why did it collapse and is this the start of a banking crisis?

Credit Suisse emergency loan sparks banking fears

Silicon Valley Bank: Global bank stocks slump despite Biden reassurances

The pertinent question is: Will they/will we ever learn?

To answer this timeless question I invite you to see a selection of postings from our GCGI archive:

‘The world economy is sleepwalking into a new financial crisis’

'Past crashes spawned new thinking and reform but nothing has changed since the 2008 banking meltdown’

Photo:theguardian.com

‘It seems that, whilst we have been obsessed and confused, out of touch with reality, messed about by the unnecessary, useless going ons with Brexit, as well as the daily nonsensical and profoundly meaningless Trump’s tweets, and more, we have somehow lost noticing the coming of a further catastrophe, namely, that another financial crisis is just around the corner…’- As noted on 21 October 2019

See also:

Is Neoliberal Economics and Economists 'The Biggest Fraud Ever Perpetrated on the World?'

The Theft of the Century by the Most 'Educated Thieves'- All with MBAs and PhDs!

My Economics and Business Educators’ Oath: My Promise to My Students

2008-2018 Crises: Have we learned anything?

The Biggest Bank Robbery of All Time by Robbers all with PhDs and MBAs in a nutshell!

$29,000,000,000,000 (This was the cost of the bank bailout to the US taxpayers by 2011. A clear sign of Socialism for a few-They get all the benefits and profits- and Capitalism for the many -They get all the losses and costs-).

The total global cost must surely be incomprehensible.

They robbed the banks and we, the people, got the AUSTERITY!!

What Happened to JUSTICE? You may ask!

Understanding and Responding to the Financial Crisis

‘Explaining the Current Financial Crisis’

Click the links below to read more about the crises and the suggested possible remedies to build a world with a higher moral compass:

2008-2018 Crises: Have we learned anything?

It’s OK to Be Angry About Capitalism

Have We lost the Art of Knowing What it Means to Be Human?

Ten Steps to Nurture and Save the World: A Perspective from a Transformed Economist

And finally, we must all begin a new journey, navigating a new path and build a new world and a better life for all:

Journey to Healing: Let Me Know What is Essential

GCGI is our journey of hope and the sweet fruit of a labour of love. It is free to access, and it is ad-free too. We spend hundreds of hours, volunteering our labour and time, spreading the word about what is good and what matters most. If you think that's a worthy mission, as we do—one with powerful leverage to make the world a better place—then, please consider offering your moral and spiritual support by joining our circle of friends, spreading the word about the GCGI and forwarding the website to all those who may be interested.

Smoky Sunrise-Yellowstone River, a painting by Paul Krapf/Via fineartamerica